Analysis of Trades and Trading Tips for the British Pound

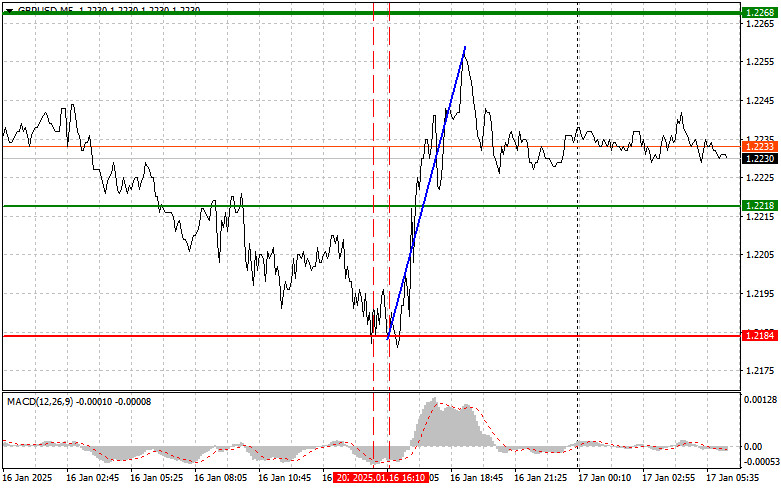

The first test of the 1.2184 price level in the afternoon coincided with the MACD indicator dropping significantly below the zero line, which limited the pair's downside potential. For this reason, I decided against selling the pound. The second test of this range occurred when the MACD was in the oversold zone, allowing for Scenario #2 to buy to materialize. As a result, the pair rose by more than 50 pips.

Yesterday's weak GDP and industrial production data from the UK negatively impacted the pound, but a major sell-off was avoided due to a disappointing U.S. retail sales report. These weak economic reports caused volatility in the pound, particularly against the U.S. dollar. Now, investors are focusing on upcoming economic reports that could provide a clearer understanding of the economic conditions in both countries. The release of UK retail sales data is anticipated and could be crucial in determining the pound's trajectory. A decline in this indicator, especially considering fuel costs, would suggest weakening consumer demand, raising concerns among economists and analysts about the future growth rates of the UK economy. These figures could exert additional pressure on the pound and lead to further market fluctuations. Conversely, positive data could enable GBP/USD to continue trading within the horizontal channel established this week.

For intraday strategies, I will rely primarily on implementing Scenario #1 and Scenario #2.

Buy Signal

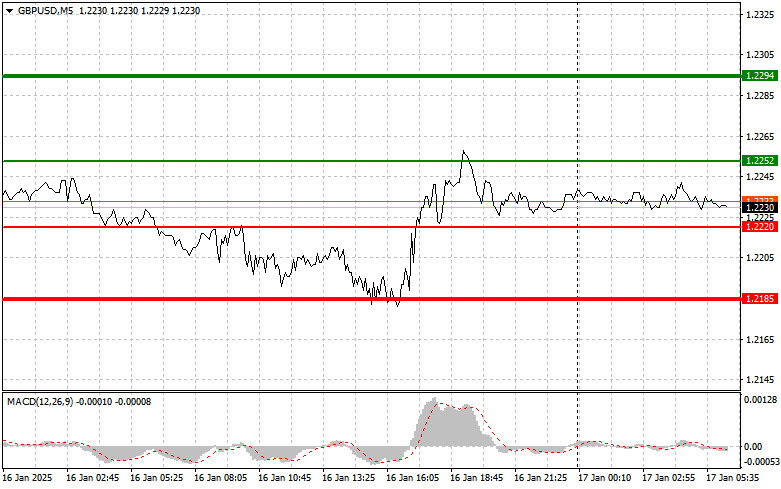

Scenario #1: I plan to buy the pound today upon reaching the entry point near 1.2252 (green line on the chart) with a target of 1.2294 (thicker green line on the chart). At the 1.2294 level, I plan to exit long positions and open short positions in the opposite direction, aiming for a movement of 30–35 pips from the entry-level. Expect the pound to rise following strong retail sales data. Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2220 price level when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger an upward market reversal. A rise toward the opposite levels of 1.2252 and 1.2294 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after breaking below the 1.2220 level (red line on the chart), which would lead to a quick decline in the pair. The key target for sellers will be 1.2185, where I plan to exit short positions and immediately open long positions in the opposite direction, aiming for a movement of 20–25 pips in the opposite direction from the level. Selling the pound is better done at higher levels in continuation of the forming bearish trend. Important! Before selling, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2252 price level when the MACD indicator is in the overbought zone. This will limit the pair's upside potential and trigger a market reversal downward. A decline to the opposite levels of 1.2220 and 1.2185 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.