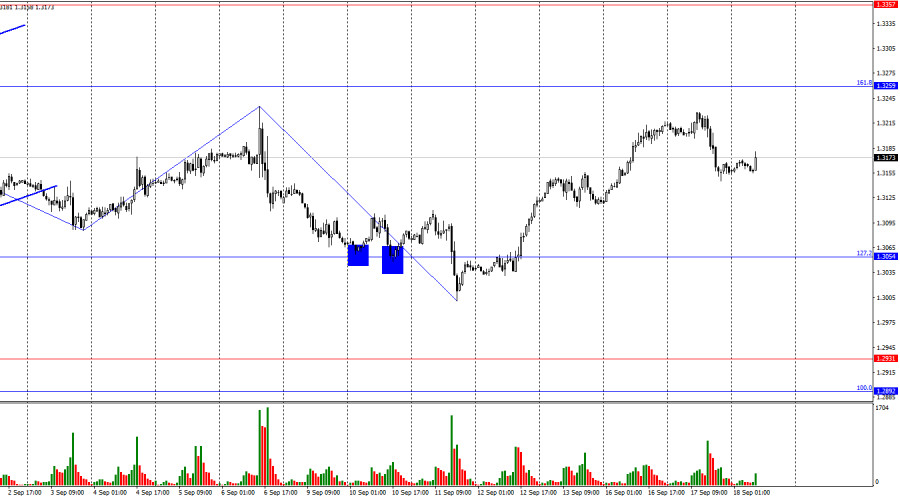

On the hourly chart, the GBP/USD pair reversed in favor of the U.S. dollar on Tuesday, with a slight drop toward the 127.2% corrective level at 1.3054. Today, I added a new level at 1.3151, from which a rebound occurred. As a result, the upward movement may resume toward the 161.8% Fibonacci level at 1.3259. Consolidation below the new level of 1.3151 would suggest a further decline toward 1.3054.

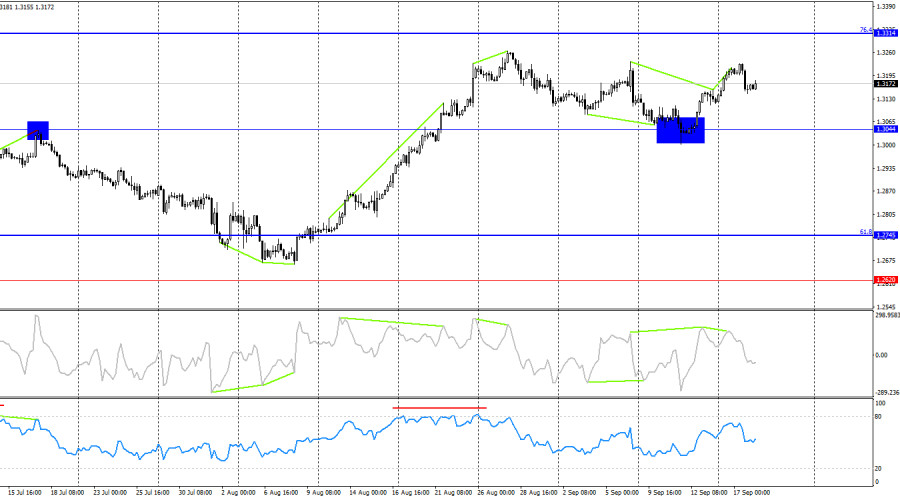

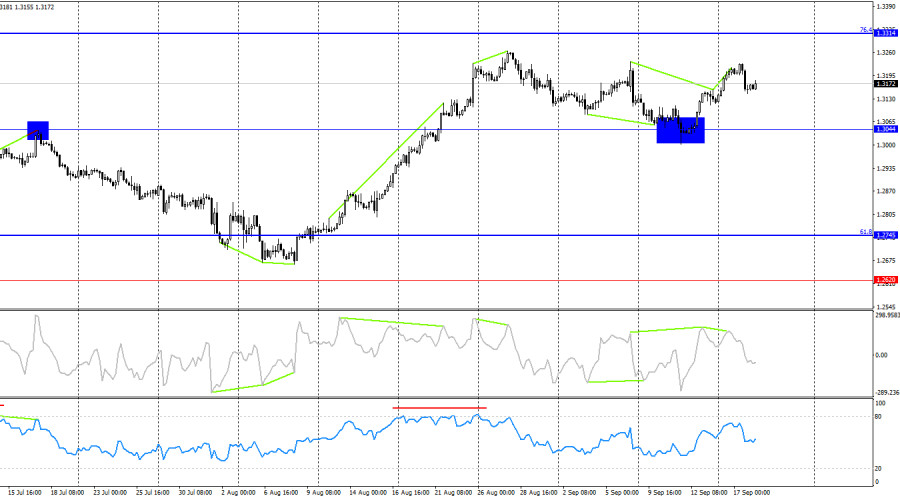

The wave situation currently raises no issues. The last completed downward wave breached the low of the previous wave, while the last completed upward wave failed to surpass the peak of the previous wave, located at 1.3264. Therefore, we are currently dealing with a "bearish" trend. The new upward wave must break the last peak from September 6 for the trend to turn "bullish" again. There's not much distance left to that peak.

Today, everything will depend on the FOMC's decisions, and tomorrow – on the Bank of England's decisions. What will influence these decisions? The situation with the Fed appears clearer. In recent months, the market has openly called for monetary easing, and the Fed is ready to meet that request. The only uncertainty is how much the interest rate will be cut. The Bank of England's decision will depend not only on general inflation but also on core inflation and services inflation. Today, it was revealed that core inflation in August rose from 3.3% to 3.6%, while services inflation increased from 5.2% to 5.6%. As a result, tomorrow the Bank of England will have no reason to lower the interest rate. For the pound, today's inflation report and the very likely decision to maintain the rate tomorrow are "bullish" factors. However, we must not forget two other factors. First, we don't know which decision traders have already factored into the current exchange rate. Second, we don't know what decision the Fed will make tonight. I wouldn't draw any bold conclusions before the FOMC meeting.

On the 4-hour chart, the pair rebounded from the 1.3044 level, reversed in favor of the pound, and continued its rise toward the 76.4% Fibonacci level at 1.3314. The CCI indicator has already formed two "bearish" divergences, suggesting a potential decline. However, despite the current bullish momentum, a third "bearish" divergence may form. The pound is overbought, as indicated by the RSI on the chart.

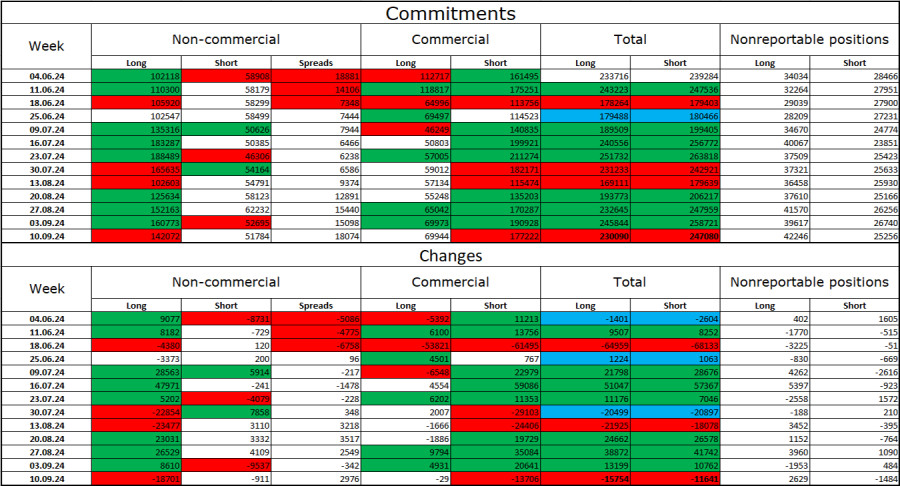

Commitments of Traders (COT) report:

The sentiment among the "Non-commercial" category of traders became significantly less "bullish" during the last reporting week. The number of long positions held by speculators decreased by 18,701, while short positions only dropped by 911. Bulls still maintain a solid advantage. The gap between long and short positions is 90,000: 142,000 versus 52,000.

In my opinion, the pound still faces downward potential, but the COT reports currently suggest otherwise. Over the last three months, the number of long positions increased from 102,000 to 142,000, while short positions decreased from 58,000 to 52,000. I believe that over time, professional traders will start reducing their long positions or increasing their short positions again, as most factors supporting the buying of the British pound have already played out. However, we must remember that this is just an assumption. Graphical analysis indicates a "bearish" trend at the moment, but it is quite unstable.

News calendar for the U.S. and U.K.:

- U.K. – Consumer Price Index (06:00 UTC).

- U.S. – Change in Building Permits (12:30 UTC).

- U.S. – Change in Housing Starts (12:30 UTC).

- U.S. – FOMC Interest Rate Decision (18:00 UTC).

- U.S. – Rate Projections for the Next Three Years (18:00 UTC).

- U.S. – FOMC Press Conference (18:30 UTC).

On Wednesday, the economic calendar contains four important entries, one of which has already been released. The impact of the information background on market sentiment for the rest of the day will be strong.

Forecast for GBP/USD and trading advice:

Selling the pair is possible today upon consolidation on the hourly chart below the 1.3151 level, with a target of 1.3054. I wouldn't rush into buying, but short-term trades could be considered with a target of 1.3259 after a rebound from the 1.3151 level.

Fibonacci grids are drawn from 1.2892 to 1.2298 on the hourly chart and from 1.4248 to 1.0404 on the 4-hour chart.