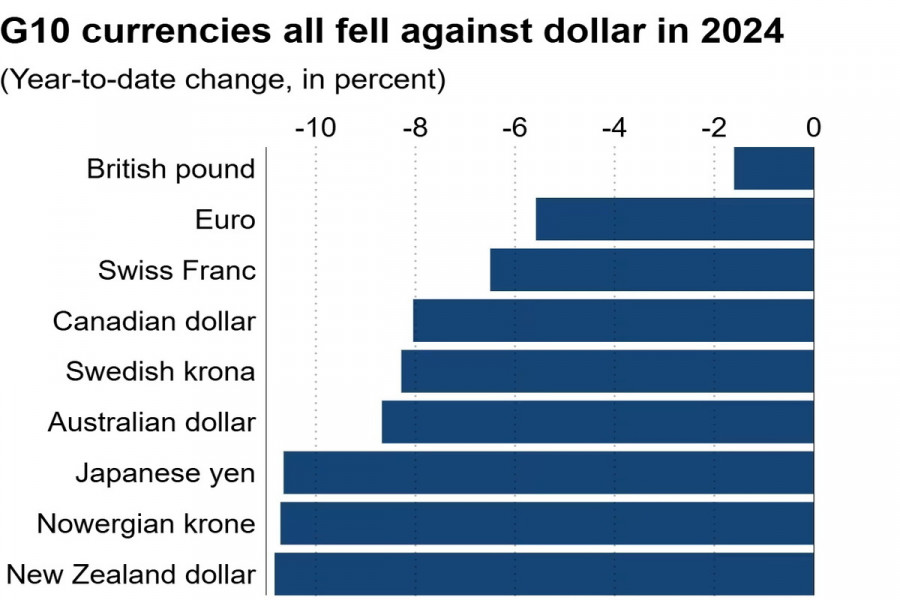

The yen has once again emerged as one of the worst-performing currencies in the G10 by the end of the year. Since January, its exchange rate against the US dollar has slumped by more than 10%, reaching a five-month low of 158.09 last week. Many analysts believe that the weakness of the Japanese currency will persist over the next 12 months, while the dollar continues to dominate the markets. Let's explore what could trigger this and how low the JPY might fall next year.

What's happening with the yen now?

Last week, the Japanese currency plummeted by 0.9% against its American counterpart, testing its lowest level since July 17 at 158.09 on Thursday.

Pressure on the yen was driven by the resurgence of carry trading involving the currency. Market participants once again began borrowing in JPY to invest in higher-yielding currencies, such as the US dollar.

The trigger for this was the ongoing monetary divergence between Japan and the United States. Importantly, both regulators held their final monetary policy meetings of the year the previous week, once again underscoring the difference in their approaches to interest rate adjustments.

At its December meeting, the Bank of Japan decided to keep borrowing costs unchanged after raising them twice this year.

Besides, the central bank made it clear that it would not rush to further normalize its monetary policy due to internal and external risks, particularly the high uncertainty surrounding the future policies of newly elected President Donald Trump.

Since Trump will officially take office just days before the Bank of Japan's January meeting, the regulator will not have enough time to assess the initial steps of the new US administration and their potential impact on the global economy.

Many market participants believe that, given the prevailing uncertainty, the Bank of Japan is likely to refrain from raising interest rates in January as well.

On the other hand, most investors currently believe that the US regulator will also refrain from making any moves on interest rates next month, after having cut them at three consecutive meetings earlier this year.

The market cemented confidence in a more hawkish Federal Reserve policy after the FOMC meeting in December, where the regulator presented updated forecasts for interest rates, inflation, and economic growth.

This month, US officials raised their previous estimates for inflation and GDP in 2025, which logically led to lower rate projections.

Right now, FOMC members anticipate two rate cuts next year, whereas in September, the dot plot indicated four dovish moves.

The case for a more hawkish Fed policy in 2025 is also supported by threats from President-elect Donald Trump to impose strict tariffs on major US trading partners as soon as he officially takes office.

Such a policy is likely to bolster economic growth and, at the same time, trigger a spike in inflation, relieving the central bank of the need to cut interest rates.

As we can see, the market currently has every reason to believe that the significant interest rate gap between the US and Japan, which has fueled the dollar's rise against the yen for more than two years, will persist into next year. For this reason, investors are once again actively buying the US dollar against the yen.

What lies ahead for the yen next year?

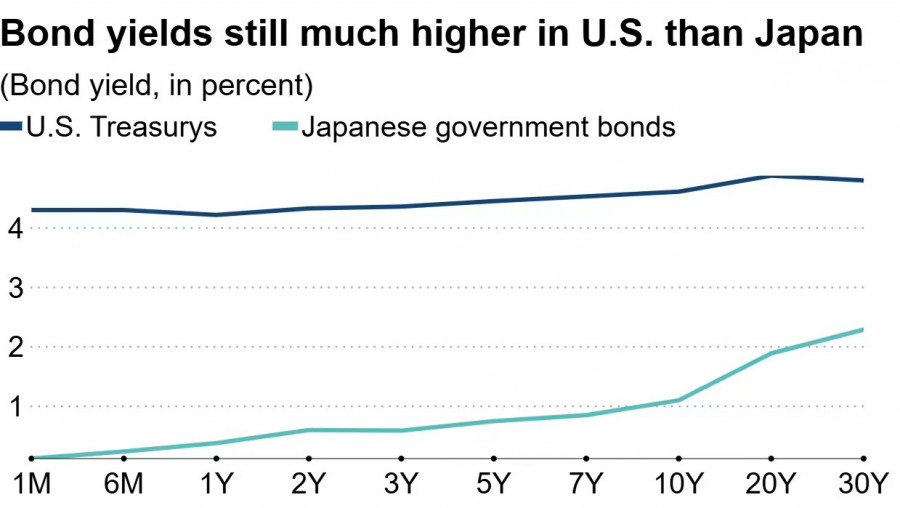

According to FactSet, the yield on 10-year US Treasury bonds is 3.5% higher than that of their Japanese counterparts. This is another reason why traders have returned to yen carry trades at the end of the year.

Since early December, the Japanese currency has fallen by 10 yen against the dollar. Many experts believe this is far from the limit and predict further weakening as the yield on 10-year US Treasuries rises, having reached a new seven-month high last week.

The increase in US bond yields is driven by market expectations of a less dovish Federal Reserve policy amid the possibility of strict trade tariffs imposed by the new US administration.

If Donald Trump follows through on his bold promises at the start of the year, this could trigger a strong bullish wave in Treasury yields, resulting in an even higher dollar, which recently hit its highest level in over two years. In turn, the yen would weaken further.

Mizuho Securities economist Seki Omori predicts a significant rise in carry trades involving the Japanese currency in the first quarter of 2025, based on expectations that both the Fed and the Bank of Japan will adjust their policies gradually. "I am confident that next year will also be marked by carry trades, and the yen will remain weak against the dollar, which will continue to strengthen across the board," the expert said.

In contrast, strategists at Societe Generale predict that by the end of next year, the yen will rise to 142.00, driven by the Bank of Japan's steady rate hikes amid persistent inflation.

However, French economists recommend that market participants trading the USD/JPY pair hedge 60% of their investments next year, anticipating high volatility in the yen's exchange rate.

Analysts at UBS Securities also warn investors about the risks of significant fluctuations in the Japanese currency. They expect the Bank of Japan to raise rates three times next year, contrary to the market's forecast of just two rounds of tightening.

"We wouldn't rule out a rate hike in Japan as early as January, considering strong inflation data in Tokyo for December and the renewed yen decline this month. If the downward trend in the Japanese currency continues, the BOJ could indeed raise rates at its next meeting to halt the yen's devaluation naturally, rather than through intervention. In that case, the yen could sharply rebound against the dollar, similar to what we saw in the summer," experts noted.

Nevertheless, UBS believes that overall, next year will be just as challenging for the yen as the current one. Analysts predict that the Japanese currency will trade at approximately the current level of 157.00 in the next 12 months and risk falling to a multi-year low of 161.00 the following year.

Current technical picture

The USD/JPY pair continues to trade with a bullish bias, hovering around 157.80 on Monday. On the daily chart, it remains firmly within an upward channel, confirming the strength of the current trend.

The existing upward momentum is also supported by the 14-day Relative Strength Index (RSI), which sits just below the 70 level. However, surpassing this mark could signal overbought conditions, potentially leading to a short-term pullback.

If the instrument breaks through the monthly high of around 158.08, this would signal continued growth. Sustained movement above this level could pave the way toward the upper border of the rising channel, located near 160.60.

On the other hand, key support lies at the 9-day exponential moving average around 156.79, coinciding with the lower border of the upward channel near 156.50. This zone serves as a critical point for maintaining the current trend. A break below it could indicate weakening bullish momentum and open the door to a deeper correction.