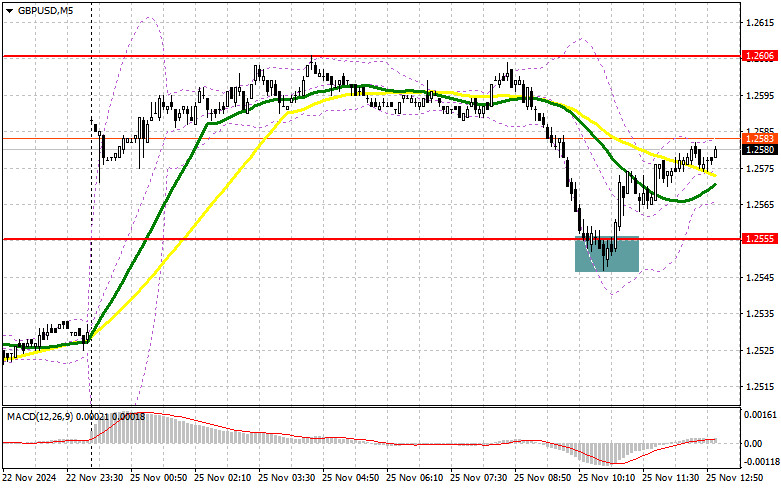

In my morning forecast, I highlighted the level of 1.2555 as a key area for making market entry decisions. Let's analyze the 5-minute chart to review what happened. A decline followed by a false breakout at this level created an opportunity to buy the pound, resulting in a rise of more than 30 points. The technical outlook for the second half of the day has been revised.

To Open Long Positions on GBP/USD:

The absence of UK economic data allowed bears to put pressure on the pound. However, buyers responded quickly, suggesting the potential for the pair to continue its upward correction in the second half of the day. With no U.S. data releases expected today, the bulls are in a favorable position. I prefer to act on a decline, entering after the formation of a false breakout near the support level of 1.2551, similar to the setup discussed earlier. This setup would confirm a valid entry point for long positions, aiming for a recovery toward the resistance level of 1.2606, which was established last Friday.

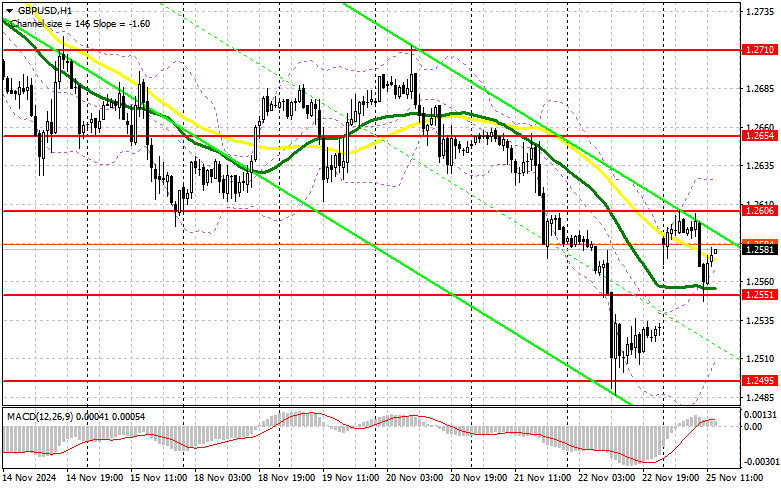

A breakout above and subsequent retest of this range will create a new opportunity for long positions, targeting 1.2654. The ultimate target is the area around 1.2710, where I plan to take profits.

If GBP/USD declines further and there is no significant bullish activity near 1.2551, bears may strengthen their trend. In that scenario, only a false breakout near the 1.2495 level would justify opening long positions. Alternatively, I plan to buy GBP/USD on a rebound from the 1.2469 low, targeting an intraday correction of 30–35 points.

To Open Short Positions on GBP/USD:

Pressure on the pound is gradually returning, so sellers remain relevant. A false breakout near the resistance level of 1.2606, combined with the absence of significant U.S. data, would signal a selling opportunity, aiming for a decline toward the monthly low of 1.2551. At this level, the moving averages, which currently support the bulls, are located.

A breakout below and retest of this range from underneath—already tested earlier today—could trigger stop-loss orders and lead to a drop toward the 1.2495 low. The ultimate target will be the area around 1.2469, where I plan to take profits.

If GBP/USD rises and there is no significant bearish activity near 1.2606, buyers could extend the correction early in the week. In this case, bears would retreat to the resistance level of 1.2654, where I would sell after a false breakout. If there is no downward movement even at this level, I will consider short positions on a rebound from 1.2710, targeting a correction of 30–35 points intraday.

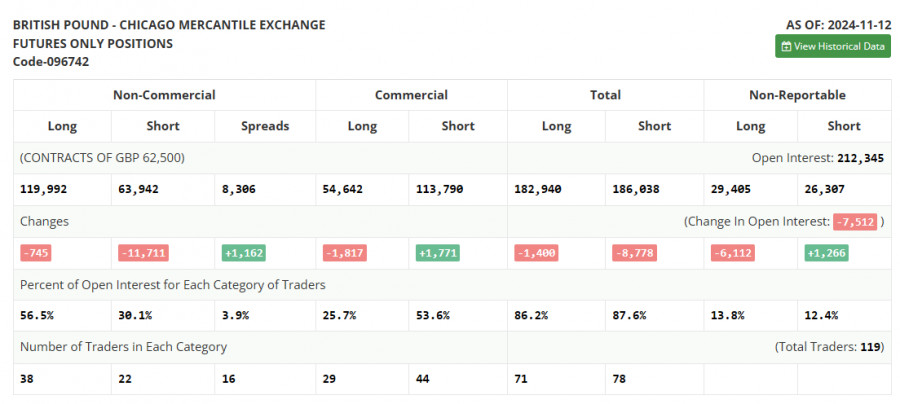

The Commitment of Traders (COT) report for November 12 revealed a reduction in both long and short positions. The data reflects Donald Trump's presidency and the Bank of England's interest rate cuts during the November meeting. However, the sharp reduction in short positions suggests that fewer traders are willing to sell at current prices.

At the same time, interest in buying remains minimal, indicating that a significant pound correction is unlikely in the near term. Considering weak UK GDP data, the justification for buying the pound weakens further. The latest COT report showed that long non-commercial positions declined by 745 to 119,992, while short non-commercial positions fell by 11,711 to 63,942. As a result, the gap between long and short positions widened by 1,162.

Indicator Signals:

Moving Averages:

Trading is slightly above the 30- and 50-day moving averages, which supports the possibility of further upward correction for the pair.

Note: The moving average periods and prices are based on the hourly H1 chart and differ from the classical daily moving averages on the D1 chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator near 1.2495 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Defines the current trend by smoothing out volatility and noise.

- Period: 50, marked in yellow on the chart.

- Period: 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence):

- Fast EMA: Period 12.

- Slow EMA: Period 26.

- SMA: Period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions: The total open long positions held by non-commercial traders.

- Short non-commercial positions: The total open short positions held by non-commercial traders.

- Total non-commercial net position: The difference between long and short positions held by non-commercial traders.